https://www.gov.uk/government/publications/spring-statement-2022-documents

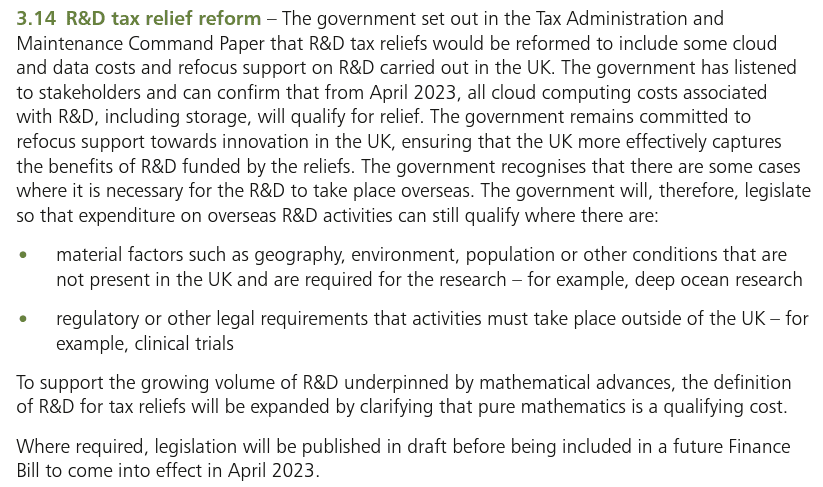

Chancellor Rishi Sunak delivered his spring statement today. This was relatively quiet on changes to the R&D schemes. The detail from the published spring statement is above.

In terms of new information:

- Expanding the definition of R&D to include pure mathematics.

- Some change to the previously announced intention to ban claims including overseas expenditure by UK companies to allow it to be claimed in very specific circumstances.

- In the speech but not the written statement a comment about considering increasing RDEC rates which is the scheme for large companies.

The statement also reiterated the aim to include cloud computing costs. Any changes announced that require legislation would be in the 2022 Budget and likely to come into force from 1st April 2023.

No mention was made in terms of legislating on R&D reporting requirements or a requirement for advanced notification to claim which have been mentioned recently and are likely to require legislation. This may be an oversight.

Comment

The focus was on other issues rather than R&D with the National Insurance threshold change and fuel duty change. With a number of recent R&D changes and some more coming in in April 2023 the lack of further changes is not surprising.

In terms of feedback from clients, the change around overseas subcontracting, not being claimable, is not particularly welcome. One was particularly frustrated and viewed overseas subcontracting as essential in terms of cost to achieving his R&D objectives. The small change does not appear to address this problem.

Allowing pure mathematics is interesting but as with much of the existing R&D schemes the devil will be in the detail, and how easy or difficult this is to reasonably interpret for a company.

The Government and HMRC have departed significantly from the prior aim of simplifying the R&D schemes and making it less arduous to claim recently. A return to this agenda would be welcome by many companies as overcomplicated R&D claim processes are off putting, this should be part of the refocus mentioned.

Chris Toms MA MAAT – Director RandDTax