The ‘Research and Development Tax Credits Statistics: September 2023’ were recently published. The report looks at the UK tax year 2021 to 2022 and compares it to previous years. But note that the 2021 to 2022 statistics are provisional and have been grossed up to account for claims not yet received.

This article presents key data and speculates on how the stats will change when the new claim rates impact the value of the SME scheme from 1st April 2023.

The headlines include that:

“The total support claimed through both R&D schemes for the tax year 2021 to 2022 is estimated to be £7.6 billion. This is an increase of 11% from last year’s total of £6.8 billion.”

“The average claim value has increased by 6% overall compared to the previous year, driven by increased support claimed in the SME scheme.”

“The total support claimed through the SME scheme has increased by 14% compared with the previous year. The total support claimed through the RDEC scheme has also increased, by 7%, since the previous year.”

This trend is not likely to continue; at least not for SMEs given that from 1st April 2023 the Research & Development claim rate for Small and Medium Enterprise (SME) claims has been significantly reduced. Although it will still be a rosy picture for large companies (with over 500 employees) claiming the Research and Development Expenditure Credit (RDEC) as the RDEC claim rate has increased (read more on this in the section further down: How will the new SME claim rates impact future stats?).

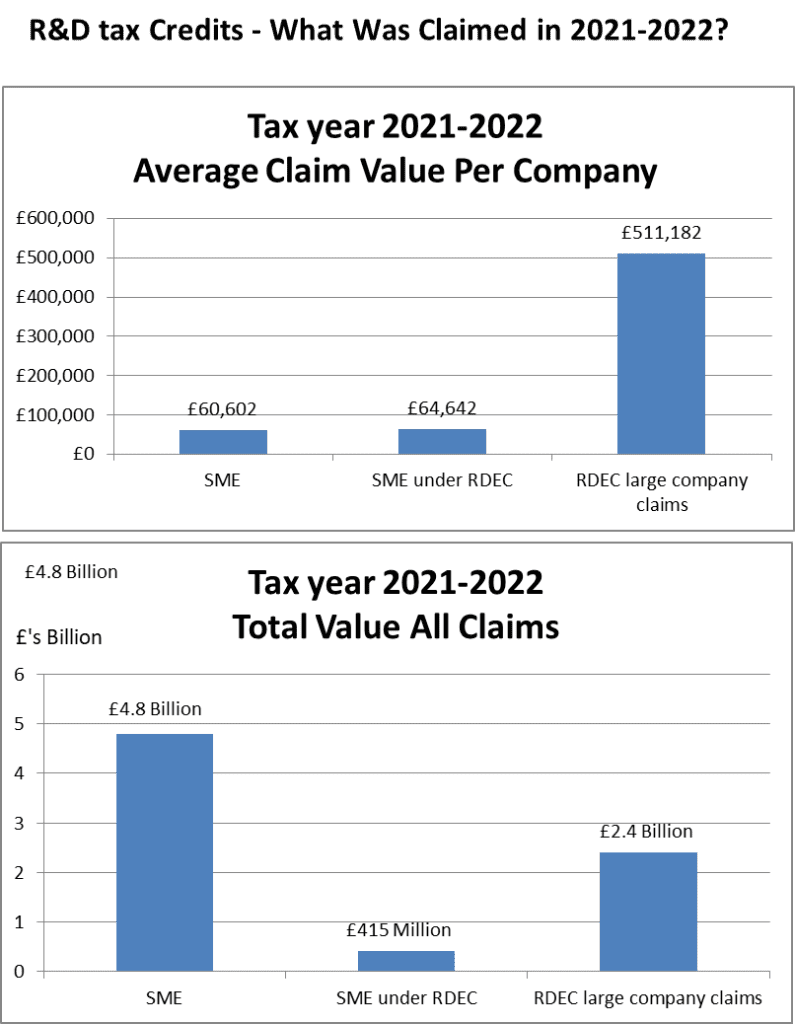

Here is a summary of the data for the 2021-2022 tax year:

- Large company claims under RDEC: – amount claimed £2.4 Billion, no. of claims 4,695 giving an average claim value of £511,182.

- SMEs claims under SME scheme: – amount claimed £4.8 Billion, no. of claims 79,205 giving an average claim value of £60,602.

- SME claims under RDEC (SMEs must claim under RDEC if undertaking the R&D as subcontractors or the R&D is subsidised by grants): – amount claimed £415 Million, no. of claims 6,420 giving an average claim value of £64,642.

The top graph that follows shows the average claim values for support provided; and the bottom graph shows the total claim value i.e. value of all the support – both are per scheme.

How will the new SME claim rates impact future stats?

Based on the new claim rates for SMEs which apply for R&D expenditure from 1st April 2023, it is anticipated that the value of support to SME claimants is likely to reduce by at least one third.

Add to this the prospect of the two schemes merging under the RDEC scheme (which could happen as early as April 2024) and that loss in value to SMEs could be as much as 50% i.e. over £2 Billion. This is because it is likely that under the merged scheme SMEs will no longer be able to claim expenditure on R&D undertaken as a subcontractor to a large company (£415 Million was claimed by SMEs as subcontractors in the 2021-2022 tax period). Plus the SME claim values will be eroded by SMEs coming under the RDEC method of calculation, where the benefit is taxed. I anticipate that this is going to reduce the value of the SME scheme to nearly half of the value of support that went to SMEs in 2021-2022. But this fact could well be obscured by the merging of the two schemes, as HMRC may no longer track and report separately on levels of support claimed by SMEs.

Read the full HMRC report here: https://www.gov.uk/government/statistics/corporate-tax-research-and-development-tax-credit/research-and-development-tax-credits-statistics-september-2023.

Linda Eziquiel – Regional Director RandDTax

1 thought on “£7.6 Billion of R&D support in 2021-2022 – an 11% increase – what’s behind the stats?”

Excellent article! Learning about RD support and the stats behind it was extremely useful for my own small business accounting UK, Nacstaccs.