The Government has announced a raft of business support measures as a result of the Covid-19 emergency. These are listed at the end of this article.

No changes have been made around key filing dates for Corporation Tax. They remain as before.

No changes have been announced to the R&D schemes. The most recent were in the Budget 2020.

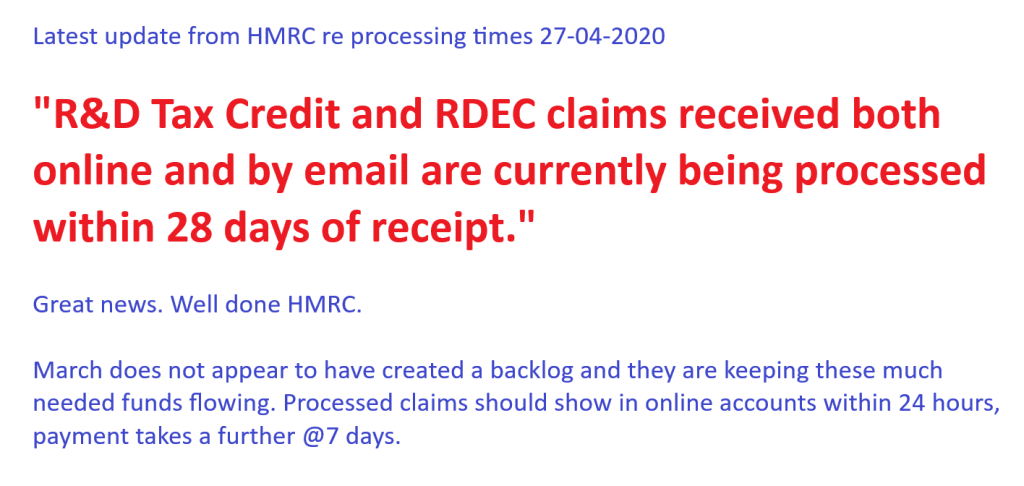

HMRC R&D TAX CREDIT CLAIM PROCESSING TIMES.

UPDATE 12/05/2020 HMRC processing 95% of claims in 28 days. Payment takes @8 days. The first place you will see a processed claim is in the company online CT account.

Practically given the cashflow issues many companies will undoubtedly face our recommendations are:

- If you think you be eligible to claim talk to us. We make claiming straightforward and easy. If you are eligible our fees are reasonable, we don't tie clients into long contracts, and our service is 100% successful.

- If you are already claiming and due any cashback we advise you to claim as soon as possible. This will be companies due R&D Tax Credits, Payable RDECs, or tax refunds where tax has already been paid and the claim is made by amending a return. This is your money we are here to help you bank it. Processing may slow so the best advice is to get in the queue asap.

- If you are not due cash and simply reducing your tax bill. You only need to claim around the time you were due to pay your tax, 9 months and a day from your year end. This is the point at which an R&D claim can save you paying out cash to HMRC.

Borrowing against R&D Tax Credit Claims

This is a possibility and we have knowledge of a number of different lenders offering this service on different terms. We do not have a referral relationship or recommend one in particular but we can put you in touch with a number.

These arrangements often require Directors Personal Guarantees and relatively high fees and rates of interest. They generally take time to arrange which if you are ready to file an R&D Tax Credit claim delays filing.

We only view this type of borrowing as a last resort if you cannot borrow from your bank. The criteria on these loans may also become tough to meet as lenders are across the board altering criteria due to the crisis.

No R&D consultancy or accountant possess a magic way to jump the HMRC queue. HMRC treat everyone the same, as you would expect. Some do claim to get “instant” payment. This is simply irresponsible advertising, do not be caught out. They have a commission based relationship with one of these lenders. This makes expensive lending more expensive. In these difficult times please be careful. If you need to use this type of service we can give you details of a number and you can chose the one that is right for you rather than get locked into one product.

A lot of Government support is available and we recommend you consider it fully with your accountant if you are struggling financially.

Check out the following useful blogs.

Government support for Business

Coronavirus Job Retention Scheme

The Bounce Back Loan Scheme (BBLS)

Coronavirus Business Interruption Loan Scheme (CBILS)

Support for businesses that pay little or no business rates

Time to Pay arrangements (TTP)

Statutory Sick Pay “SSP” for small or medium-sized businesses