What are the deadlines for making an R&D Tax Credit claim?

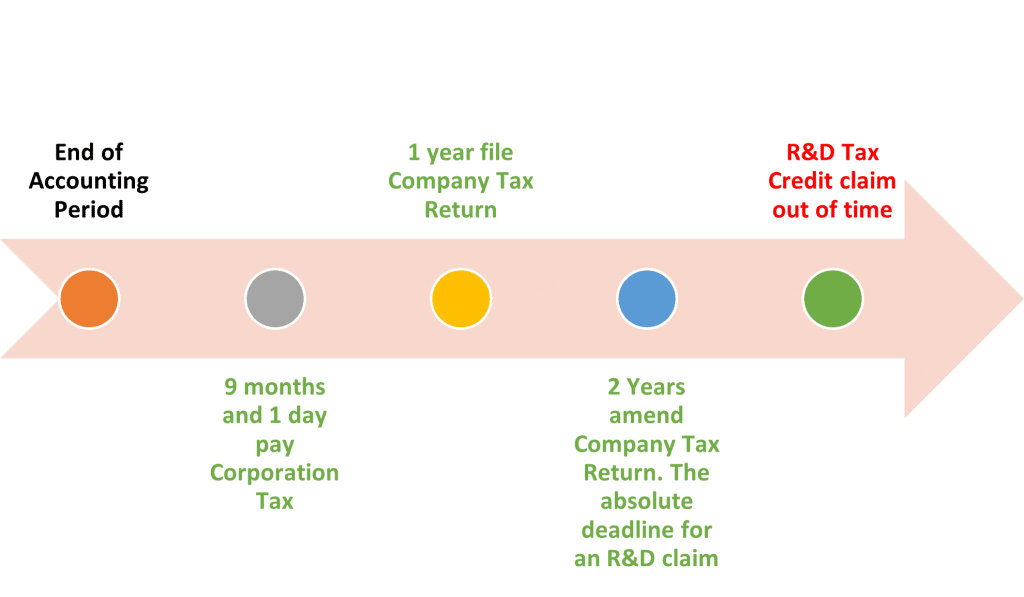

An R&D Tax credit/relief claim is made through the company tax return known as the CT600. The deadlines for filing and amending are therefore the same as those for the CT600.

Any Corporation Tax due must be paid within 9 months and 1 day of the accounting period end. All that must be done at this point is to pay any tax due, but most profitable companies will also file the tax return at the same time as they need to have done all the work to calculate the tax due.

The deadline for filing the tax return is one year after the accounting period end.

The deadline for amending the company tax return is two years after the accounting period end. This is the absolute deadline for making an R&D claim for the accounting period.

If a company misses the two-year deadline to make an R&D claim will HMRC extend it?

This is very unlikely. HMRC would only accept a return beyond this date in exceptional circumstances, e.g., the accountant falling ill on the day he was due to file, or a massive technical breakdown around software or power outages on the last day to file. They assess these case by case and need evidence. They are not convinced by workload reasons for missing a deadline, after all 2 years were available to fit in the claim. If the potential to claim is only learned about after the deadline for an accounting period the claim is lost for that period.

If a company has a lengthened or shortened accounting period does this impact the R&D Claim deadlines?

No or only positively, the deadlines are set on the accounting period end date not the 12-month limit on the CT600 period. So, if an 18-month accounting period ended on the 31st March 2019 any qualifying expenditure could be claimed by an amended return filed before 31st March 2021 for the entire 18 month accounting period. This is positive because for year-long accounting periods you can only claim 24 months expenditure, but if the oldest accounting period is lengthened, then more can be claimed. In the case of an 18 month period then 30 months of expenditure would be available.

Were any of R&D Tax Credit filing deadlines changed due to the Covid-19 situation?

No, none of the deadlines for corporation tax were extended. The only deadline related to the tax return was the obligation to file accounts at Companies House within 9 months of the accounting period end. But this is not a tax/HMRC deadline as such.

What happens if a company misses any of the deadlines set out for an R&D Tax Credit claim?

Fines will be levied if a company misses the deadline to pay Corporation Tax or file the Company Tax Return.

The potentially more costly deadline would be missing the absolute 2 year for the accounting period end deadline to make an R&D claim, either through an initial or amended tax return. The average benefit is in the region of £60k and missing that deadline can be expensive in the sense of the lost opportunity/cash.

How quickly after an accounting period end should a company claim R&D Tax Credits/Relief?

Cashflow is a key consideration here:

A claim for a cash R&D Tax Credit or payable RDEC should be made as soon after the year end as possible. Once a return is filed which includes a R&D Tax Credit Claim this is paid by HMRC within 28 days in 95% of claims. Sometimes payments are processed even more quickly. HMRC have done a great job maintaining this speed of processing during the Covid-19 crisis and deserve massive credit for this in tough circumstances.

If a company has not paid Corporation Tax but is due to then the point the cashflow benefit arrives is when the cash was due to be paid, e.g., 9 months and 1 day after the accounting period end. The same principle applies for an RDEC claim which reduces the CT due.

If a company has made a return and paid any tax due but then decides to make an R&D claim which either leads to a corporation tax repayment or R&D Tax Credit or a combination of both then the claim should be made as soon as possible to bring in cash.

What is poor cashflow management around R&D Tax Credit/Relief claims?

Deadlines are always dangerous as some people will always aim to just meet them. Therefore, some companies claim on the 2-year deadline year after year. This is a sub-prime approach. Money that is the company's is being left with HMRC for up to 15 months longer than is ever necessary. If the company only works for the two-year deadline and work pressures happen in those last few days HMRC will not listen to excuses if the deadline is missed. It is not worth the risk. Luckily, most companies see the logic of claiming and gaining the benefit as soon as possible.

Please get in touch and we can help answer any questions you have about R&D claims.

Christopher Toms – Technical Director RandDTax