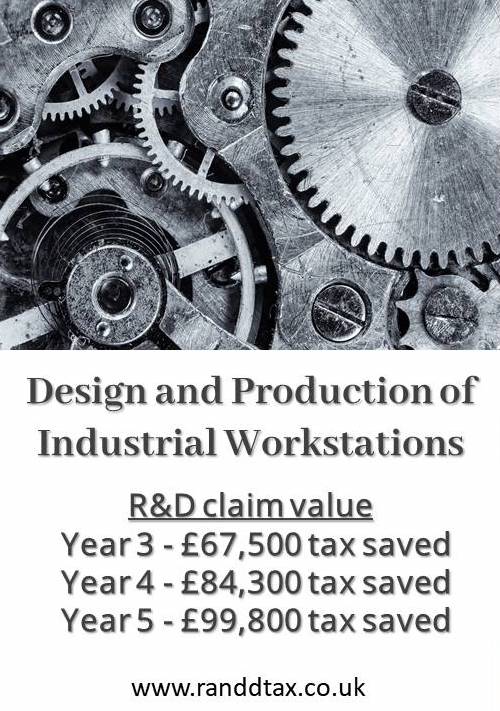

Example of an R&D tax relief claim for innovation in assembly and production machinery and technology for industrial workstations, in manufacturing sectors. This example also includes 3D modelling with the total claim value exceeding £250K over a three year period. Contact our specialist advisors for support with identifying whether your development costs qualify and to find out how we would assist you in making R&D tax credit and relief claims.

An engineering leader in the automotive industry, pioneering new manufacturing methods.

- Developing complex assembly and automated wrapping production techniques.

- Transforming CAD 3D modelling into fully designed prototypes.

- Creating innovative production processes to handle bespoke shapes.

This company benefited from more than £250,000 in R & D tax relief. See how much your business could benefit from with our R and D Tax credit calculator.