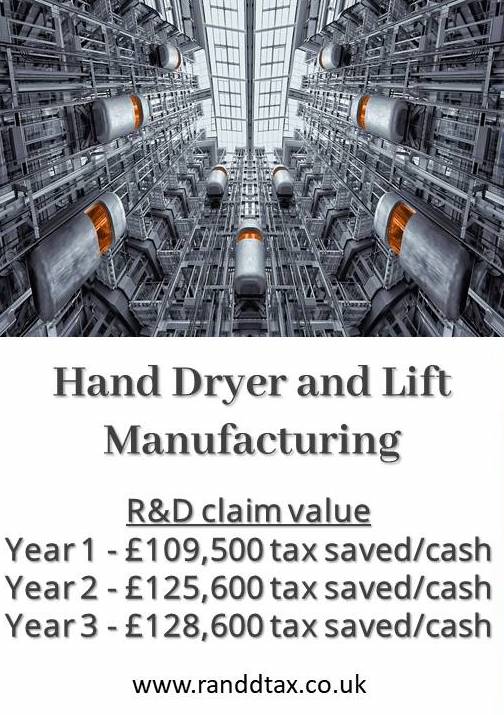

UK Manufacturers are major beneficiaries of R&D Tax Credit and Relief – £440,000 over three years in this example. UK manufacturing companies are good at innovation but getting funding to invest in research and development is frequently a challenge, even more-so now as business interruption from Covid-19 takes hold. Following significant investment in R&D, the Hand Dryer and Lift Manufacturer in this mini case study made advances in aspects of how its products function. The company’s total claim value, over three years, was just above £440,000. This extra cash formed a significant incentive to maintain the push towards achieving pioneering improvements to some of its key products.

Developments and improvements in respect of how hand driers and lifts function:

- Advances in hand drier user detectors.

- Infra red light curtain development for entry to lifts.

- Advances in air flow capabilities in hand driers.

- Improvements in wifi and connectability of announcement systems in lifts.

This company claimed over £400,000 in R & D tax credits. TO see how much you could claim, use our R & D Tax credit calculator.