Many businesses miss out on R & D tax credits because they believe their industry is not eligible. But that is often not the case. Here is an example of how a family farming business was able to benefit from R & D tax credits and make their business more efficient.

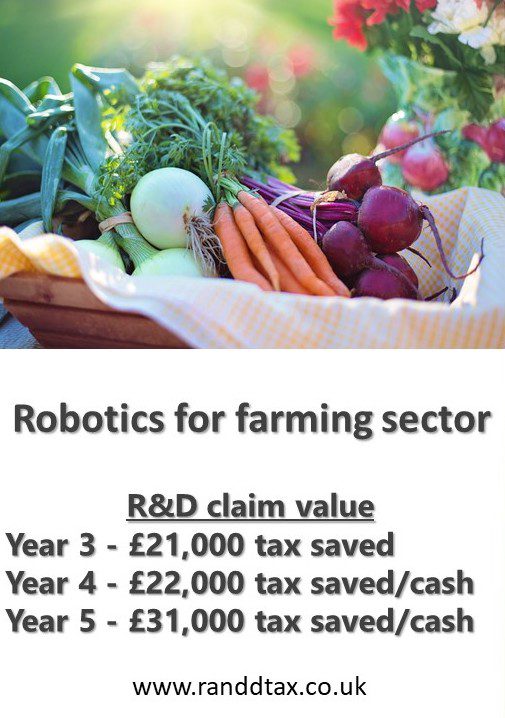

Development of robotics usually qualifies for R&D tax credit and relief – here's an example of innovation in robotics in the farming industry. This family business is developing bagging robotics for vegetables. This helps the business through:

- Automating packaging of produce

- Capable of fast material conveying and packaging

- Stacking and bagging contact sensitive produce such as flowers

This company benefited from £74,000 in R & D tax relief.See how much you could benefit from with our R&D tax credit calculator.