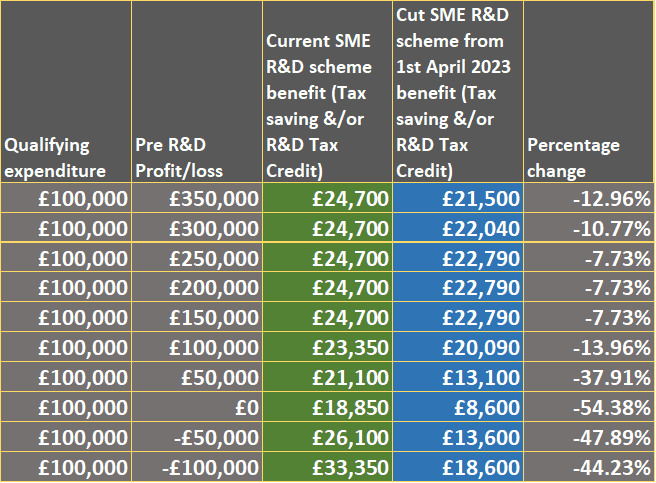

The autumn statement brought grim news for SMEs as the Government cut the SME R&D schemes. The additional deduction rate was cut from 130% to 86% and the R&D Tax Credit rate was reduced from 14.5% to 10%. The cumulative impact of these changes is that the tax saving an SME R&D claim generates was cut from about 25% of R&D to typically 22%, but changes to corporation tax complicated this picture. The hardest hit are loss making SMEs claiming R&D Tax Credits and their rates fell from a range of about 19%-33% to 9%-19%. So this means an SME currently benefiting from receiving 33p per £1 of R&D expenditure as a payable tax credit, will now only receive just under 19p per £1

The table below shows some more detailed analysis and shows the impact on a claim for £100,000 of qualifying expenditure at various profit and loss levels.

SMEs are a vital part of the economy because they drive innovation. This is the worse possible time for the Government to cut this vital funding. It is indicative of a Government that makes policy on the hoof as it lurches from one crisis to another.

RDEC, the Large company scheme, saw a rate rise from 13% to 20% due to be effective from 1st April 2023. Large companies are far better able to access funding and investment than SMEs and this major shift in policy appears to completely ignore the importance of SMEs to growth in the UK. I would suggest any company adversely affected by these changes lobby their MP to reverse course, which is something the Government has shown itself to be good at in recent times.

The cuts to SME R&D tax credits mean it even more important than ever to ensure you don't miss out on the tax credits you are entitled to. Contact RAndDTax to being your claim for R & D tax relief.

Christopher Toms MA MAAT – Director RandDTax