R&D Tax Credits for your industry

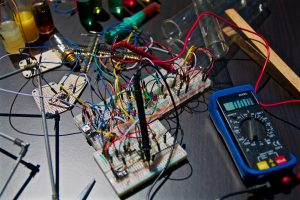

Don’t miss out on R&D tax credits due to the misconception that R&D only takes place in the lab, or that what your industry does won’t be eligible.

At RandD Tax, our team has worked with businesses from many different industries, to identify eligible R&D work, process the claim, and maximise your R&D tax credit claim. You won’t miss out vital funds when you choose RandD Tax.

Digital marketing agencies, business services companies, IT businesses and car restorers are just some examples of the businesses that have benefited by claiming with RandD Tax.

Your Industry

If you want to claim with RandD Tax, but aren’t sure if you are eligible you should contact us. We will be able to help you determine if you can make a claim. Our FREE ASSESSMENT will even give you an estimate of how much you should receive.

If you need more information, simply choose your industry from the menu:

We have referred many of our clients to RandDTax since 2013. They have some 26 consultants covering the UK, going to where our Clients are based and responding immediately; and and RandDTax are also fee competitive when compared to some firms offering this service, charging rather less than most. All in all, RandDTax are a knowledgeable, reliable and responsive specialist Research and Development Tax Relief Consultancy and a useful partner for DPC in offering enhanced services to our Clients.

Valerie Wood - Director

We have introduced several of our Clients to RandDTax. Without exception, they have been delighted with the efficient service and support in maximising their claims. For us at Haines Watts, we find RandDTax to be responsive, supportive and they really know how to work well, alongside us, re-enforcing the service that we offer to our Clients.

Steve Butler - FCA

We have worked for the last three years with Jaime Lumsden of RandDTax, successfully securing Tax Credits and Rebates, year on year, for some of our Clients working in the web-based software sector. Maclean Carmichael has found RandDTax to be efficient and knowledgeable, both for our Clients and ourselves. R&D Tax Relief is a specialist area and with Jaime’s support, we have helped our Clients’ to maximise both cash rebates and reductions in Corporation Tax payable. In particular, RandDTax responds quickly to our questions and allows us to submit the claims promptly leading to HMRC settlement, often in less than five weeks.

Ishan Madan

Nothing but a pleasure to deal with RandDTax, straightforward advice, quick and fantastic results for our clients

Lynne Crawford - Director

With such a valuable HMRC incentive available we highlight the relevance of R & D to our clients and invite them to work with Linda of RandD Tax to review their position and submit claims. Linda has been instrumental in securing the R&D Tax relief for a number of our clients in a timely and professional manner and I would highly recommend her services to any client who is eligible for such reliefs. Thank you for making what could be a minefield a very painless exercise for our clients.

Jenny Tolmie - Partner

Linda at RandDTax has been a pleasure to work with. We have found the whole process very efficient and instrumental in getting fantastic results for our clients.

Jenny Rainer FCCA

My firm has worked with Terry Toms of RandDTax for several years and, without exception, he has been extremely helpful and knowledgeable both in terms of advising where R & D tax relief would be available and in assisting our clients direct in putting together the appropriate report for the purposes of HMRC. His understanding of what HMRC would expect in order that claims are processed as painlessly as possible has also been invaluable. We would thoroughly recommend RandDTax.

Gary Clamp

We have worked with RandDTax to provide our clients with specialist advice and support in claiming R&D tax relief and tax credits. As a result our more innovative clients have made successful R&D claims, which has helped to fund their investment in R&D. We have found Linda Eziquiel, our lead advisor from RandDTax, to be knowledgeable, efficient and pleasant to work with.

Chris Ranson

We have worked with RandDTax for close to four years and many of our clients have benefitted from their services. They are especially good at recognising, scoping and describing qualifying R&D while our clients are often unsure of the valid interpretation of all the technical HMRC rules and guidelines. RandDTax help make the claim process simple, secure and fast. We found that on average, R&D specialist consulting firms will charge between 20% to 35% of tax recovered or tax credits paid, whereas the RandDTax charge is much lower – so great value for money.

Ian Condie