As part of our new website build our consultants filled out a questionnaire. See the full responses on each consultant profile, as we go into more details about some questions and answers.

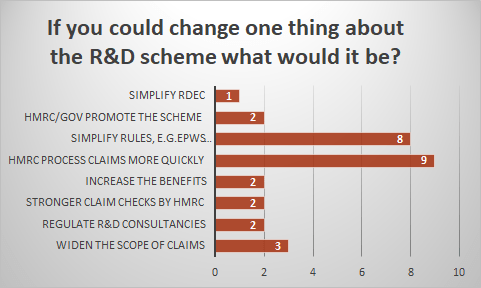

Here are our insights on reforming the R&D schemes:

The response that made me smile the most was from Vicky Hall one of our Accountants and our Finance Director.

”RDEC – what sort of mind invented this scheme?!” Vicky Hall.

You need quite a bit of knowledge of RDEC and the SME scheme to understand this point. But the old Large Company scheme which had similarities to the SME scheme has been replaced by something completely different. If, as is possible, both types of scheme are applied to one claim they actively work against each other. One creates extra income (RDEC) the other increases the amount of expense relating to R&D (The SME additional deduction of 130%), they are opposites. New tax law should have simplification at its centre and RDEC is unnecessarily complicated.

The largest number of responses involved faster HMRC processing times of R&D claims. When the questionnaire was issued this was at the front of most consultants minds as the KPI of 95% of R&D Tax Credit claims being processed in 28 days had not been met very consistently for about 18 months. But HMRC have altered the process and to their great credit in the very difficult Covid 19 period have kept this crucial funding flowing.

The next most popular suggestion involves simplifying the schemes. To be honest there are aspects of the legislation which consultants have to explain to clients for compliance reasons that non specialists find hard to understand on the basis of reasonableness and common sense. Again in tax law this is not a good outcome. Consultants don't enjoy being put in a situation where we are saying “I know it does not make sense but it is the law and you have to follow it”. In particular rules around EPWs, Subcontractors, Grants, and SMEs claiming under RDEC need simplification.

”Make it less bewildering for SMEs so that they can more easily claim.” Paula Newton.

“I would simplify the way the rules are published and explained. They aren’t particularly accessible.” Jen Raison.

”EPW costs could be qualifying even if they are not invoiced through a Ltd company.” Tim Walsh.

As a long established specialist in our field, that is compliant (PCRT, Anti Money Laundering) and beyond that believes in behaving fairly in business, a few suggestions have been made about our profession based on the poor behaviour we sometimes see by competitors. Fees and the poor quality advice we sometimes see are concerning.

“The Government or HMRC to cap the exorbitant fees levels some of the ‘ambulance -chaser’ R&D tax credit claims companies are charging. 20% to 40%+ is undeserved and not in the spirit of the scheme.” Alan Crouch.

A very popular call has also been made by a few to increase the benefit to companies from the the R&D schemes. RDEC has just increased from 12% to 13%. But until we fully exit the EU and know which areas the UK government will be free to set policy on the SME scheme is limited by EU law. Public finances due to Covid 19 may also not allow greater spending.

“I’d double the level of benefit – if only!” Linda Eziquiel.

A few consultants also suggested increasing the scope of the R&D schemes into areas or costs currently not claimable. This is being reviewed in a small way by the Government as a result of the March 2020 Budget. Arguably widening the scope could be a way to simplify the scheme.

We are actively engaged through the RDCC (R&D Consultative Committee, made up of HRCC R&D Tax specialists and Agents) and by contributing to consultations to improving the R&D schemes. If you would like to talk to us about your R&D claim get in touch here. We have the knowledge and experience to help you get your claim right.