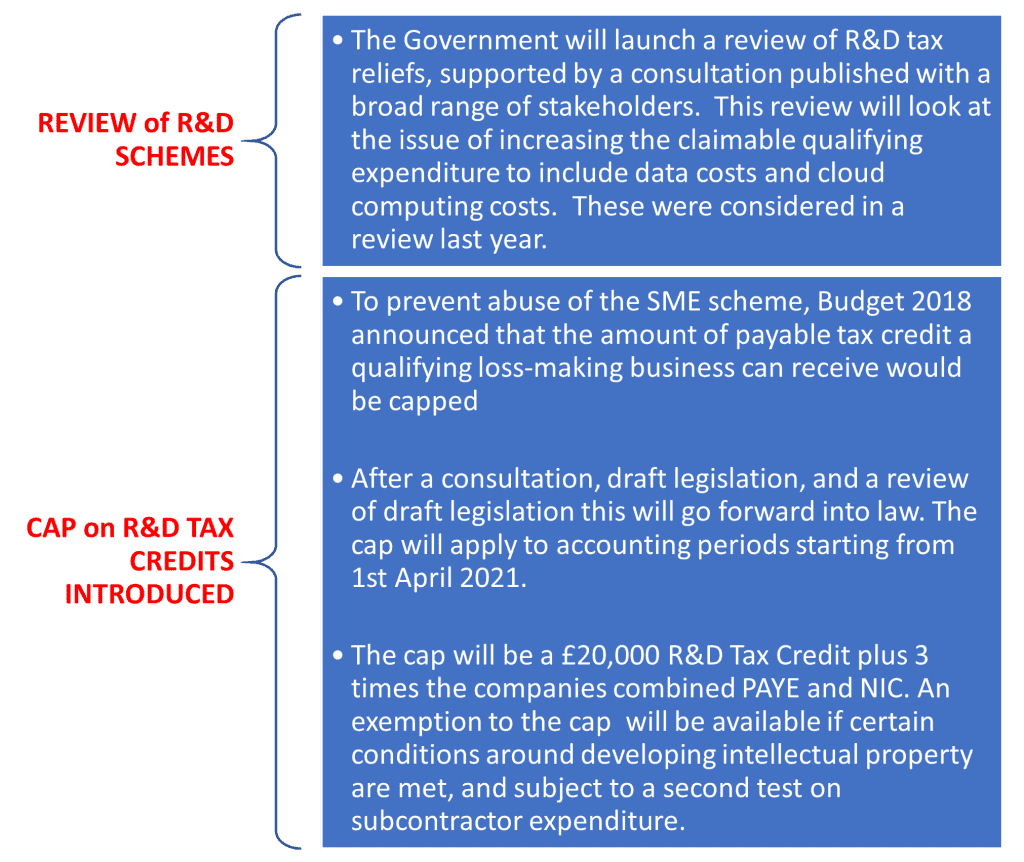

Other than the introduction of the cap on payable R&D Tax Credits, which was known about and in the draft Finance Bill, the budget brought no major changes for the R&D schemes.

The cap has improved from the mechanism originally announced in 2018. If a company is heavily impacted a change to the draft legislation announced yesterday offers a potentially less abrupt transition. It had been announced that for accounting periods that run through 1st April 2021 that the cap would apply to expenditure from 1st April 2021. They reversed this back to the change only applying to accounting periods starting after 1st April 2021. This makes the calculations simpler. It also offers the potential for companies to adjust accounting period ends, shorten then lengthen, to make the change less immediate. Based on a review of our clients, very few are impacted anyway.

The announced review and consultation of both schemes (SME R&D Tax Credits/Relief and Large Company RDEC) can lead to speculation. But no evidence exits that the conservative government is looking to use this to abandon either scheme. In fact the aim appears to be improvement. I don't want to turn my blog into a “Yes Minister” routine. But, yes, sometimes civil service improvement and simplification does the opposite. Brexit offers the opportunity for genuine simplification if some of the EU State Aid red tape can be removed from the SME scheme.

https://www.gov.uk/government/consultations/rd-tax-reliefs-consultation

The other big announcement was the increase in Corporation Tax to 25% with some tapering by 2023. This changes the benefit from the R&D schemes in some circumstances.

- RDEC for example will be worth less, if a company is taxed at the higher rates as the RDEC credit is taxed.

- SME R&D Tax Relief claims, e.g. claims that reduce profits, will bring greater benefits. For example £100,000 of relief can save £19,000 in Corporation Tax (CT) at present but at 25% could save as much as £25,000. This looks good but profitable companies will have to pay more tax on profits that are not relieved therefore depending on the level of profits companies could be worse off in terms of the tax due.

- SME R&D Tax Credit claims are less obviously impacted. But a claim involves surrendering losses that could be used for future tax relief. At present the choice is between a 14.5% rate now against 19% in future tax relief if profitable, the change makes the differential 14.5% v 25%. Companies should think carefully about taking R&D Tax Credits on that basis as the opportunity cost has risen. On £100,000 of losses tax relief at 25% would be worth £10,500 more than surrendering the losses for an R&D Tax Credit, but future tax relief is not cash now and depends on future profits. Making this type of decision always involves a degree of crystal ball gazing as it involves projections and unknowns.

The temporary increase in the number of years a firm can carry back losses, from one to three, is intended to help firms which generate Covid-19 losses to turn these into cash more quickly. This will also help loss making R&D firms who have unrelieved profits in the prior three years to generate cash. Tax relief is more valuable at 19% than claiming an R&D Tax Credit at 14.5%. This is a time limited change for accounting periods ending between 1st April 2020 and 31st March 2022.

Extended Loss Carry Back for Businesses – GOV.UK (www.gov.uk)

We are always here to help if you have any questions about this blog or R&D claims in general.

Christopher Toms – Technical Director RandDTax