Overview.

An R&D Tax credit is available if a trading loss exists after the R&D additional deduction. The current deduction rate is 130%.

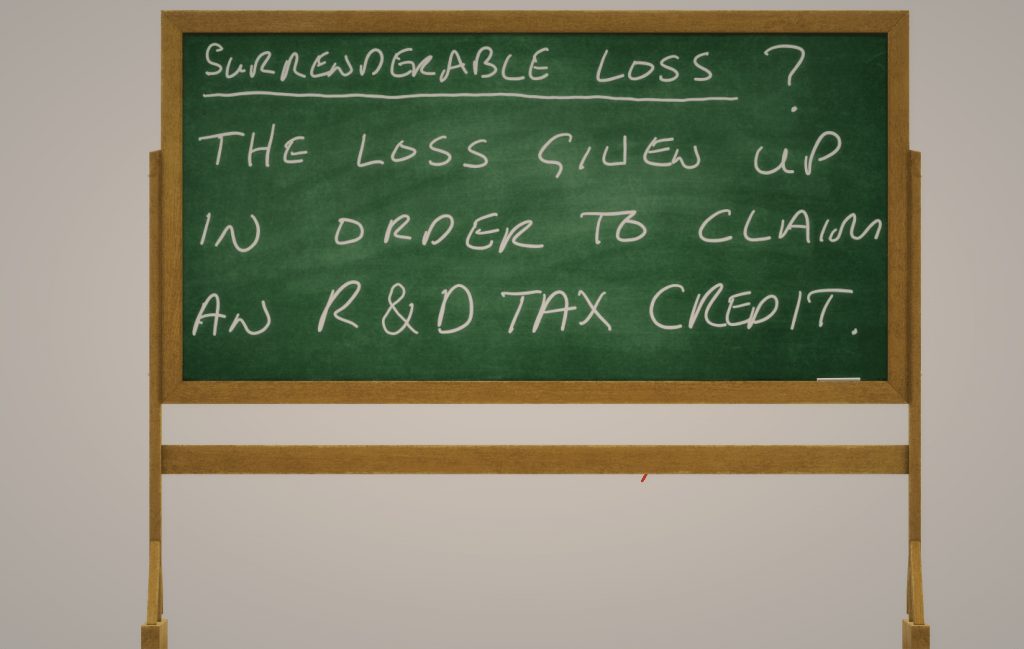

An option exists to surrender the loss for a payable tax credit (A restriction on the payable tax credit is due to be implemented for accounting periods starting from 1st April 2020 of 3 x Company PAYE+NIC). Contact RandD Tax to discuss surrenderable loss and R & D tax credits.

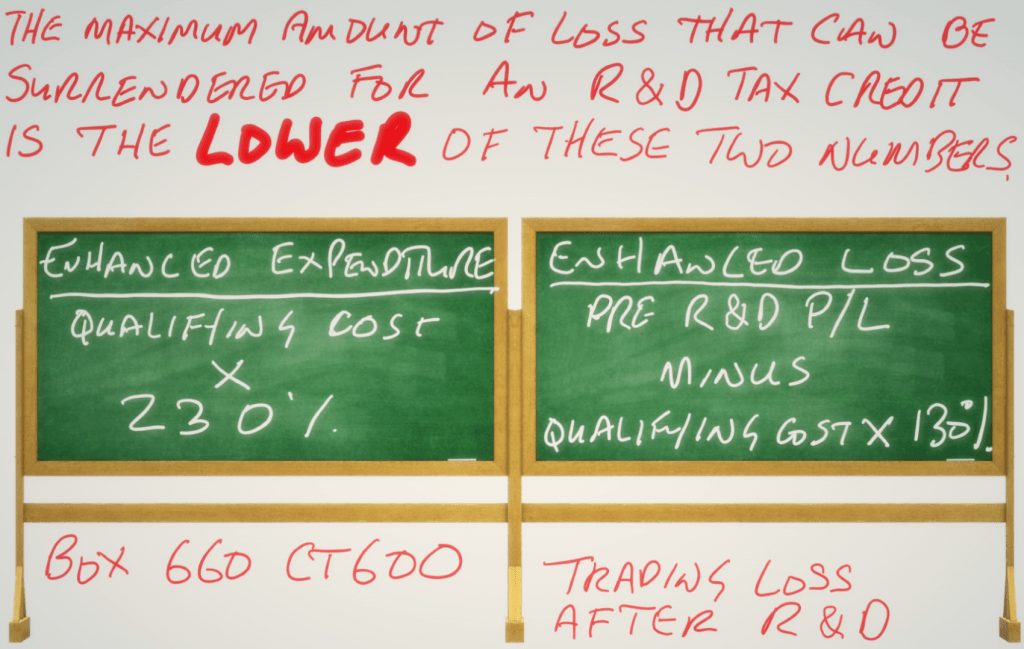

The surrenderable loss is the lower of the trading loss after the additional deduction and the enhanced expenditure (Qualifying costs plus the additional deduction which is 230% of the qualifying costs).

The available tax credit is 14.5% of the surrenderable loss as described above.

HMRC aim to process 95% of R&D Tax Credit claims in 28 days.

Legislative basis CTA 2009.

The additional deduction is described in CTA2009 1044. The rate mentioned there is historic and the current rate is 130%.

After the R&D additional deduction (sometimes described as the R&D enhancement or enhanced deduction) the company must have a “Chapter 2 Surrenderable Loss” CTA 2009 1055.

“(a) so much of the trading loss as is unrelieved, or

(b) if less, 175% of the qualifying Chapter 2 expenditure in respect of which

the relief was obtained.”

175% is a historic rate the current rate is 230%.

CTA2009 1058

“(1) The amount of the R&D tax credit to which a company is entitled for an

accounting period is—

(a) 14% of the amount of the Chapter 2 surrenderable loss for the period, or”

Current rate is 14.5%

The “or” relatives to a previously removed PAYE and NIC cap. A new cap may come in of 3 times PAYE and NIC liabilities for accounting periods starting on 1st April 2020.

Key points and common myths.

- R&D Tax credits exist so loss making company can receive a benefit. The mechanism is surrendering losses that qualify for a tax credit of 14.5% of the amount surrendered. Unprofitable companies can get cash.

- We have seen cases where accountants have not been aware of point 1 and make an R&D claim and just carry forward losses. An option exists not to take an available R&D Tax Credit. If for example a loss can be carried back for tax relief it is optimal to do so as tax relief @19-20% brings a greater benefit than the tax credit surrender rate of 14.5%. Alternatively a decision may be taken to carry all or some of the surenderable losses forward for future tax relief. The key judgement is likely future profitability versus the need for cash now. Most companies take cash now through the R&D Tax Credit.

- We have seen cases where confusion exists about the amount of losses that can be surrendered for a tax credit. Some accountants mistakenly think it is only based on the 130% additional deduction. When in fact it can be based on as much as 230% of the qualifying costs depending on how much of that 230% is unrelieved.

- If a cap is introduced in 2020 and companies lack sufficient PAYE and NIC liabilities to claim a full R&D Tax Credit then the losses relating to the capped portion of the tax credit will be carried forward.

- Surrendering a loss for a tax credit means that the loss cannot be carried forward. That would be double counting. If you surrender £100k carried forward losses are reduced by £100k. An obvious point and not a mistake we have seen but HMRC have mentioned it in R&D Webinars as a potential area for error.

Example 1

Total qualifying costs £125,000

Additional deduction (130%) £162,500 (deduction in tax computation)

Enhanced Expenditure 230% £287,500 (CT600 box 660, also check box 650)

Loss before the additional deduction £400,000

Enhanced loss including additional deduction £400,000+£162,500=£562,500

Chapter 2 surrenderable loss is £287,500

R&D Tax Credit is £287,500 @ 14.5%=£41,687.50 (CT600 boxes 530, 875),

Losses to carry forward £275,000

Example 2

Using the same qualifying cost, additional deduction, and enhanced expenditure.

Loss before the additional deduction £50,000

Enhanced loss including additional deduction £50,000+£162,500=£212,500

Chapter 2 Surrenderable loss is £212,500

R&D Tax Credit is £212,500 @ 14.5%=£30,812.50 (CT600 boxes 530,875)

Losses to carry forward are zero.

Conclusion

One of the hard issues to understand about R&D Tax Credits is that the pre R&D tax position influences the amount of the payable tax credit.

Example 1 is optimal because the pre R&D loss is greater than the qualifying costs. None of those costs have been used relief tax. Therefore, a credit of £41,687.50 is available.

In Example 2 the pre R&D loss is smaller. If you add back the qualifying costs of £125,000 the company would have a profit of £75,000. To put it another way £75,000 of the expenditure has already attracted relief and crucially is also does not create a loss. So the R&D tax credit is £75,000 @ 14.5% = £10,875 smaller.

£41,687.50-£10,875=£30,812.50

In cashflow terms the company is worse off. But remember that £75,000 has attracted tax relief at 19% worth £14,250. It would be a bit odd to say a company is better off being loss making. But a company with than existing loss at least as big as its R&D qualifying costs will get the maximum amount of R&D Tax Credit worth 33.35% of its qualifying costs.

It is important that the filing accountant understands what the output on the tax computation and CT600 should be entered as correctly and does not rely on the software to get it right. If you are unsure about filing any aspect of an R&D claim correctly please contact us and we can help.

Christopher Toms MA MAAT – Technical Director RandDTax