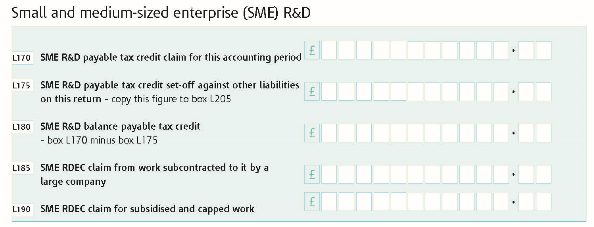

HMRC have made changes to the CT600 which include an extra supplement CT600L for claiming either type of R&D related Tax Credit, the SME R&D Tax Credit & RDEC for large companies. These went live on 6th April 2021.

Here is the new CT600L and the CT600L guide. Contact RandD Tax if you want to discuss changes to CT600.

As with many software roll outs this one is not without problems. It is an evolving situation but at present two types of issues exist.

- Some Software providers have not updated their software to reflect the change. Therefore R&D claims cannot be filed. Our understanding based on limited feedback early in the month is that this only effects credit claims, but it is not 100% clear and it could impact all R&D claims. The HMRC view is that software providers have had plenty of time to update software and to reflect the changes. They were informed about them in August last year. The picture can be more complicated than that as it unlikely developers were given a final specification in August last year. At present based on claims where we have actually seen filing attempted, Tax Calc has been updated and works while SAGE has not been updated and gives an error message saying it will not be patched until May. We have not tried to file using Tax Filer but have been told by them it is not updated as HMRC only gave them the final specification a few days ago, while IRIS who own Tax Filer say IRIS has been updated. It is a slightly muddled picture but if you are using tax software that is not updated I do think you should ask your provider why? Especially given that Tax Calc have managed.

- A CT service issue or “bug” i.e. a software issue exists around the carry forward of RDEC on the new supplement. This is a relatively rare issue in terms of the RDEC calculation steps. This is due to be patched by HMRC at the end of May. Here are the full details.

The HMRC advice if you cannot file digitally is to wait or post in a return. Posting in a return is not a great option as processing is likely to be very slow. Waiting may not be possible if you are facing a two year deadline and is not good for a claimants cashflow. This is not helpful to companies relying on the cash injection an R&D claim brings in these difficult times. An alternative might be to buy a tax software package that works, it will overcome the first issue described but not the second.

If you do post in a return remember to post everything required CT600 and CT600L and any other supplemental pages plus fill in form WT1 explaining (in Box 6) that your software provider has not updated yet and placing WT1 on top of the return. This should be sent to Corporation Tax Services, HM Revenue and Customs, BX9 1AX, United Kingdom.

This article is intended to help accountants who run into problems to understand the context and will be updated when further information emerges. If you have any questions please feel free to contact us.

Christopher Toms – Technical Director RandDtax.