Key headlines.

- The estimated total number of R&D tax credit claims for the year ending March 2020 is 85,900, an increase of 16% from the previous year. The increase is primarily driven by a 16% rise in the number of SME R&D claims to 76,225.

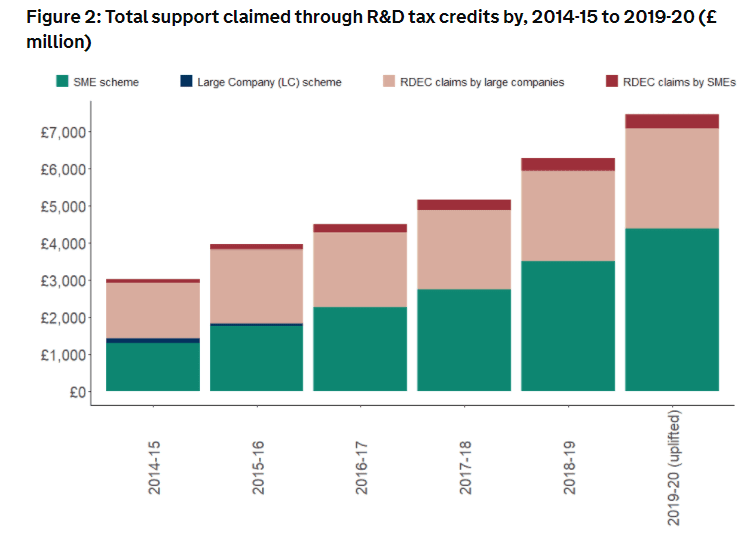

- The estimated total amount of R&D tax relief support claimed for the year ending March 2020 is £7.4 billion, an increase of 19% from the previous year. This corresponds to £47.5 billion of R&D expenditure, 15% higher than the previous year.

- There is a concentration of claims by companies with registered offices in London (20% of total claims and 31% of total amount claimed), and the South East (15% of total claims and 18% of total amount claimed). However, the registered office location may not be where all the R&D activity takes place.

- The Information and Communication, Manufacturing, and Professional, Scientific and Technical sectors continued to have the greatest volume of claims, making up 64% of claims and 69% of the total amount claimed for the year ending March 2020.

Source: National Statistics Research and Development Tax Credits Statistics: September 2021

Comment.

The numbers represent a continued growth in the R&D schemes driven by SME claims. With a March 2020 cut off what they don't tell us critically is the impact of Covid-19 and lockdowns on R&D activity, so in that respect does not represent the contemporary position of R&D investment and R&D Businesses. In the past a trajectory could be assumed from the numbers but the impact of Covid is potentially a wildcard. Another potential area of change could be the impact of Brexit. The really interesting period to consider will be the next one, and given that R&D claims can be made up to 2 years from an accounting period end the true picture won't fully emerge until September 2023 when the full statistics for the March 2021 year will be available.

The rise in “cost” of the R&D schemes to £7.4 billion for the period does raise a concern that the larger the number becomes the greater an area of interest it might be for Government cuts necessitated by Covid. But to make such cuts would be to run contrary to a central plank of successive Chancellors of both main parties economic policy around R&D investment. R&D investment is about economic growth and cuts in this area might be viewed economically as “cutting off one's nose to spite your face” or just plain dumb. But we do live under the curse of “interesting times” and it will be revealing to see what view Chancellor Rishi Sunak takes in the 27th October 2021 Autumn Budget.

Chris Toms – Compliance Director – RandDTax