Quite lengthy conditions exist around what qualifies and what does not in both legislation and HMRC tax manuals. When a company works through the guidelines themselves it can be off putting for several reasons. For example, some sections lack clarity and require experience and context. For this reason, jumping straight into the detail is not always effective.

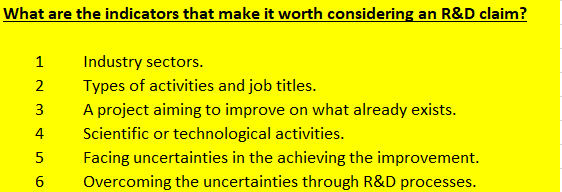

So, what I am going to do is look at the indicators which make it worthwhile to investigate a potential claim in more detail. The things I think about in a short conversation. I am going to use language outside the guidelines to filter out non qualifying companies and try and identify those where it is worth drilling down to actual “rules”. I am also going to focus on qualifying activity today rather than the more accountancy based aspects of cost headers that qualify, company size, and how a claim is calculated and filed.

Indicators. What are the applicable industries?

No list exists in the guidelines. But the main ones in very broad terms are:

- Manufacturing

- Software

- Engineering

- Contractors

- Telecoms

- Pharmaceuticals

- Biotechnology

It might also be that a company’s main activity is not one of these sectors, but they have a department that operates in one of these areas or subcontract out development. A Bank might not be regarded as a software company but do develop quite a lot of both software and hardware technologies. For example, recent advances in contactless payments. I have also not listed electronics as an individual industry as it falls under both manufacturing and engineering. A lengthier list can be found here:

Indicators. What people do and job titles.

- R&D Departments

- Scientists

- Product Engineers

- Process Engineers

- Product Development

- Process Development

- Software Development

- Technology Development

- Apply for Patents

These all represent areas where some of the activity might be R&D. They are part of the filtering process. Just because a company for example is doing software development it does not mean they will have a claim just that if they are it is worth looking at things further.

Indicators. Understanding what research and development is for tax purposes.

Individuals often think of R&D as ground-breaking technology, new discoveries, expanding the principles of science, and world firsts. This is often either called pure research, fundamental research, or basic research. The image is people in white coats at universities. This is a very narrow definition and if this was the definition in which R&D Tax claims had to operate very few companies would qualify. I have worked on Rocket science R&D claims, but most claims are not!

The definition for tax relief purposes is expanded and broader than the conception above. The view above stops some companies from thinking about claiming. The definition for tax relief purposes is relatively lengthy and needs to be considered case by case, project by project. But an overview would include four key elements without getting extremely jargon heavy.

A project aiming to improve on what already exists. This might be an element of a new or existing product, process, technique, formula, invention, or software item. R&D often starts with identifying a problem. It does not need to be a world first. Even relatively small and incremental improvements can be R&D for tax purposes. The research does not have to be successful; a claim can be made for a project that failed. The key activity is the effort.

Scientific or technological in nature. Utilising principles of the hard sciences. These might be chemistry, biology, physics, engineering, or computer science. This requirement is present to rule out research based for example on economics, the law, finance, the arts, humanities, or the social sciences. This can be about utilising existing principles in science or technology. R&D can be about either feasibility or practical applications.

Uncertainty exists i.e. the available information in the public domain, what is known by competent professionals in the field, does not establish the capability, method, or appropriate design of the goal in point one. Uncertainty must be related to both the development of the goal and the science or technology. At the outset questions may exist for example “Can it be done?”, “How to do it?”, “What is the appropriate design?”, “What are the potential ‘choke points' in the project road map?”, and “Is there a risk of failure?”.

Overcoming the uncertainties through R&D processes. This could be experimentation, prototyping, iterative development, testing, analysing data, brainstorming, researching options and alternative approaches, technical or technological problem solving, trying approaches outside the well-known and documented ones. Following existing blueprints is not R&D but coming up with a new blueprint to achieve a project goal is a good indicator of R&D activity.

Chris Toms – Director RandDTax.