The very quick answer is the R&D allowable cost.

| Total allowable cost (100%) | £238,950 |

| R&D enhancement (130%) | £310,635 |

| R&D enhanced expenditure (100%+130%=230%) | £549,585 |

The R&D enhancement is described in a number of ways in tax computations. The most useful and least used, is R&D additional deduction (CTA2009 1044). It is also described as the R&D enhancement and R&D enhanced deduction. The problem with those terms, while correct if you understand the calculation, is they generate confusion with the term “enhanced expenditure”. This term is the allowable cost/expenditure plus the additional 130%. Or to put it another the enhanced expenditure is 230% of the allowable cost. Confused? Contact RandDTax to make a research and development tax credits claim with the support of experienced consultants.

Understanding these terms is important in correctly calculating R&D Tax Relief. To add further potential for confusion different tax software packages show R&D differently. Some show just an additional deduction of 130%, while others add back the 100% allowable cost and then deduct the enhanced expenditure 230%. Both methods are valid as obviously they lead to the correct additional deduction of 130%.

Understanding how much to deduct is important and a common error we see is accountants deducting 230% without any add back of 100%. This means more tax relief is being claimed than is allowed under the R&D scheme.

| Correct Method 1 | ||

| Profit per accounts | £500,000 | |

| Add depreciation | £75,000 | |

| Deduct Capital allowances | £25,000 | |

| Deduct R&D enhancement | £310,635 | |

| Trading Profit | £239,365 |

| Correct Method 2 | ||

| Profit Per accounts | £500,000 | |

| Add depreciation | £75,000 | |

| Add R&D Expenditure | £238,950 | |

| Deduct Capital Allowances | £25,000 | |

| Deduct R&D Enhanced Expenditure | £549,585 | |

| Trading Profit | £239,365 |

| Incorrect Calculation | ||

| Profit Per Accounts | £500,000 | |

| Add depreciation | £75000 | |

| Deduct Capital allowances | £25,000 | |

| Deduct R&D Enhanced Expenditure | £549,585 | |

| Trading Profit | £415 |

By calculating incorrectly an extra £238,950 has been deducted which at 19% has reduced the corporation tax due by £45,400. This would be an embarrassing error for an accountant to explain to their client or HMRC at enquiry!

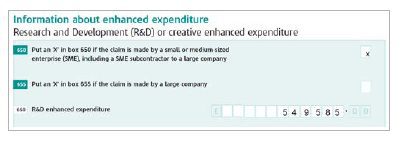

One potential reason for the above mistake is that the CT600 in box 660, version 3, asks for the “enhanced expenditure”.

This requirement may explain why those using method 1 jump to the incorrect calculation to make the numbers “fit”. But as explained you simply have to understand the different terminology and that the enhanced expenditure and enhancement are different things, the difference is the allowable cost & as in most cases (Intangible assets are a niche issue where the allowable cost needs to be added back in the tax computation to be claimable) the allowable costs are already in the accounts. You cannot double count.

At RandDTax we have massive experience of all the accountancy issues around claiming R&D Tax Credits and offer training through CPD workshops and support for all the accountants we work with. Get in touch today to benefit from our experience.

Christopher Toms – Technical Director