Full details of the autumn statement changes can be fund here.

What is an R&D Tax Credit? R&D claims create an additional deduction in the tax computation. The current rate is 130% of qualifying expenditure and this is due to fall to 86% from the 1st April 2023. If after this deduction a claiming company is making a loss, then the option to surrender some or all of that loss for an R&D Tax Credit exists. The loss after an R&D deduction is known as the enhanced loss. The maximum amount of loss that can surrendered is the lower of the enhanced loss and the enhanced expenditure. The enhanced expenditure is currently 230% of qualifying expenditure and this is due to fall to 186% from 1st April 2023.

The company has the option to take the available R&D Tax Credit or not and can even just surrender some of the losses while leaving the remaining losses to be carried back or forward for future tax relief.

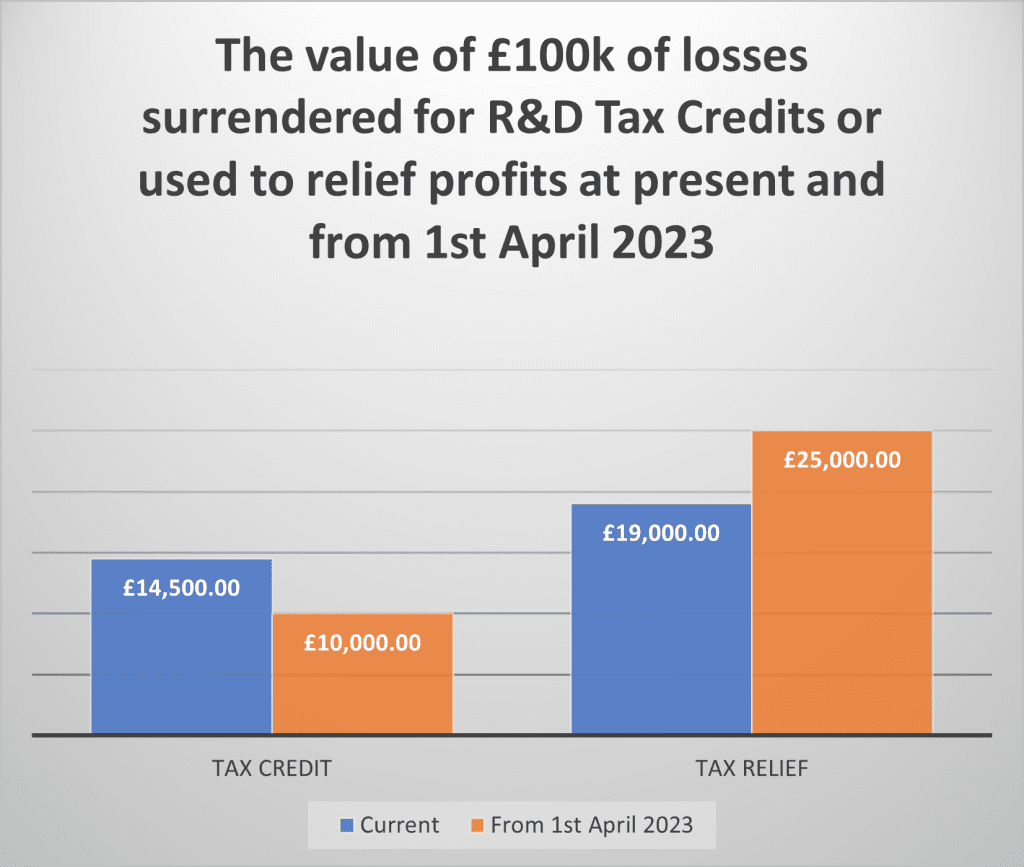

This is important as tax relief is always more valuable than surrendering a loss for an R&D Tax Credit. But unless the option exists to carry losses back a year (Covid extended carry back allowed 3 years) or forward to a completed future year a degree of risk exists that the losses might not be used for future tax relief. This will depend on future profits, potentially after future years R&D claims. Such a decision depends on making a future estimate of profitability which might not be certain. An R&D Tax Credit gives a certainty of benefit but at a discounted rate. This discount is currently 14.5% versus 19%, so surrendering losses for an R&D Tax Credit is worth 4.5% less of the loss being surrendered than if it can be used for tax relief or to put it another way the monetary value is worth 23.7% less taking the credit than using a loss for tax relief.

How do the changes to rates in the autumn statement alter the decision to take an R&D Tax Credit or not? Most obviously the discount that a claimant must accept when taking an R&D Tax Credit will increase massively as not only has the R&D Tax Credit percentage dropped to 10% at the same time corporation tax will increase to a headline 25%. The corporation tax rate is not straightforward as the rate is tapered with profits up to £50k charged at 19%, then each additional pound above £50k until £250k charged at 26.5%, and profits at £250k charged at 25%. But even if we take the 19% tax rate the discount in cash terms for taking an R&D Tax Credit doubles to 9% (10% versus 19%), while at 25% corporation tax it is 15% (10% versus 25%). To put it another way at the 25% corporation tax rate surrendering losses for an R&D Tax Credit is worth 40% of the potential future tax relief.

It is pretty clear that unless a company urgently needs money now, or believes it has no chance of profitability in the next few years that the best value is found in not taking an R&D Tax Credit. But if you make that decision, you are taking a risk, in the sense that if the company never makes enough profit to use the losses, then they are worth nothing. But most well run businesses will have fairly reliable projections so the decision is not totally blind.

The drop in the enhanced deduction rate to 86% is also important as profitable companies on a similar R&D spend will have a smaller deduction. Albeit this is likely to be at a higher tax rate. But this change should weigh on decisions being made even at the current rates. It could be very lucrative to not surrender losses now that include the 130% deduction rate and carry them forward to reduce future profits and tax liabilities at 25%. The discount between the current R&D Tax Credit rate of 14.5% and the approaching corporation tax rate at 25% is a huge 10.5%. to put it another way you get 42% less cash benefit for surrendering losses by claiming the R&D Tax Credit.

The point of this blog is to make it clear that the decision to take an R&D Tax Credit or not is much more weighted to not taking R&D Tax Credits than previously. This decision should considered carefully and discussed with you adviser. Contact us today so we can help you make the smart decision.

Chris Toms MA MAAT -Director RandDTax